What is happening with the European Central Bank (ECB) and interest rates?

The European Central Bank is strongly expected to cut interest rates on the 6th of June 2024.

What has the ECB said about this?

The Vice President of the ECB, Luis de Guindos, said in April that an interest rate cut in June is a “fait accompli”. The ECB’s Chief Economist, Philip Lane, strongly hinted to the Financial Times this week about a rate cut and Olli Reihn, the head of Finland’s central bank has said that the “time is ripe” for an interest rate cut in June.

Why are members of the ECB saying this?

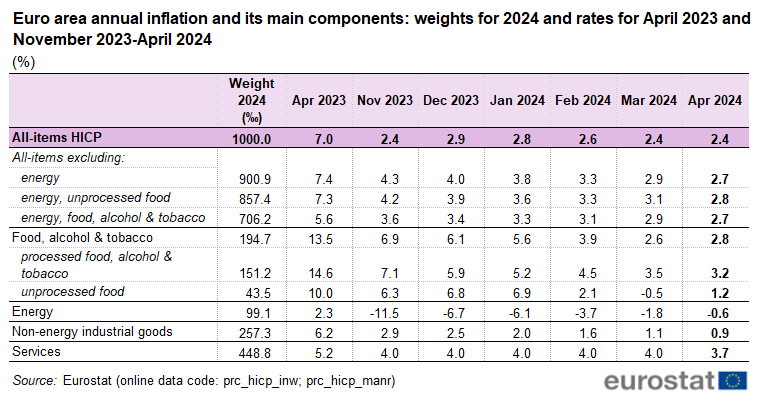

Eurozone inflation has been falling more than expected, from 7% in April 2023 to 2.4% in March and April 2024:

France is releasing its preliminary May inflation data on Friday, which was at 2.2% in April. Friday’s data will make the scale of any interest rate cut clearer.

Update: Friday 31st May: The French inflation data has been released and and the May 2023 to 2024 inflation rate is 2.2%, the same as April 2023 to April 2024. Across the Eurozone, inflation from May 2023 to May 2024 was 2.6%. An interest rate cut is still expected.

What does this mean for my personal finances?

Mortgage interest rates in Eurozone economies, including France, may drop further. In April 2024, the average interest rate for a new residential mortgage was 3.81%. You can read more about this in our May 2024 French Property Market Update. Interest rates for other loans may also fall.

However, interest rates on savings accounts may also fall too, for instance, one popular tax-free savings account in France, the Livret A, is currently paying an interest rate of 3%, but this is due to be reviewed before January 2025.

How can Aisa International help me?

Aisa International is regulated to provide investment advice in different European countries, including France. Feel free to contact us for a relaxed initial conversation about how we could help you with your investment planning.

The views expressed in this article are not to be construed as personal advice. Therefore, you should contact a qualified, and ideally, regulated adviser in order to obtain up-to-date personal advice with regard to your own personal circumstances. Consequently, if you do not, then you are acting under your own authority and deemed “execution only”. Additionally, the author does not accept any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Importantly, this article is dated and is based on legislation as of the date. It should be noted that legislation changes, but articles are rarely updated. Sometimes a new article is written; so, please check for later articles. Additionally, check for changes in legislation on official government websites. Finally, this article should not be relied on in isolation.