Stock market crashes are a relatively common part of the investment landscape. While they can be emotionally devastating and financially challenging, history shows us that markets have always recovered from even the most severe downturns. The key is knowing how to respond thoughtfully rather than panicking.

Stay Calm and Avoid Emotional Decisions

The most critical action during a market crash is often inaction. When portfolios plummet by 20%, 30%, or more, the natural human response can be to panic and sell everything to “stop the bleeding.” This instinct, while understandable, is often counterproductive.

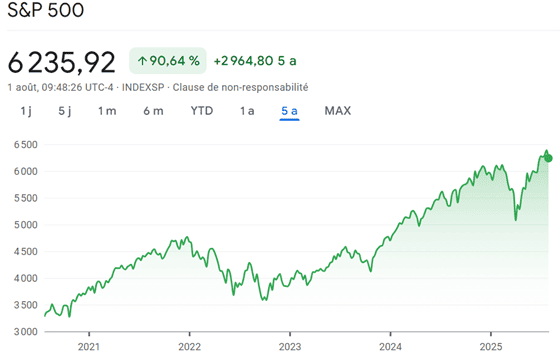

Market crashes create a psychological perfect storm. Fear dominates rational thinking, leading to hasty decisions that can lock in massive losses. Remember that market volatility is temporary, but poor decisions made during volatile periods can have lasting consequences.To illustrate this, check out the performance of the largest US stock market index, the S&P500 over the past five years:

As you can see, stockmarkets normally recover from downturns and crashes. However, a word of warning, this can take an awful long time, such as when the Japense asset bubble burst in 1990:

Perhaps take time to process the situation before making any major moves. Step away from your portfolio tracking apps, limit your consumption of financial news, and give yourself space to think clearly about your long-term goals.

Assess Your Financial Foundation

Before making any investment decisions, contact your financial adviser (or us) and evaluate your immediate financial security. You could start by reviewing your emergency fund. Financial experts typically recommend having three to 12 months of expenses saved in easily accessible accounts, however this depends upon your personal circumstances.

Consider your timeline for essential expenses. If you need money within the next two to three years for a home purchase, education, or other significant costs, that money shouldn’t be invested in volatile assets regardless of market conditions.

Review and Rebalance Your Portfolio

Market crashes often create imbalances in carefully constructed portfolios. If you had a 70% stock and 30% bond allocation, a significant stock market decline might shift this to 60% stocks and 40% bonds. This presents an opportunity to rebalance by selling some bonds and buying more stocks at lower prices. Financial advisers such as ourselves specialise in portfolio rebalancing.

A financial adviser can also review your asset allocation to ensure it still matches your risk tolerance, capacity for investment loss and investment time horizon. A market crash might reveal that you were taking on more risk than you could psychologically handle. It is also not simple to choose investments which match your risk tolerance, for example: most government bond funds have historically be seen as relatively low risk, but due to the large interest rate fluctuations and monetary policy interventions by central banks since the 2008 financial crisis, most government bond funds have been very volatile.

Understand Tax Implications

Selling investments can create tax liabilities, and for our fellow expatriates: the country in which any gains are taxed can depend upon your country of origin, your lengh of residence and if you qualify for any special tax regimes, such as the French impatriate tax regime. Aisa International France you can you in touch with a French tax professional to help you with this.

Avoid Common Mistakes

Several behaviors during market crashes can severely damage long-term wealth building. Panic selling often locks in losses and also often means missing the initial stages of recovery, which historically have been some of the strongest periods for market returns.

Trying to time the market by waiting for the “bottom” can be is equally dangerous. No one consistently predicts market bottoms, and waiting for confirmation that the worst is over often means missing significant portions of the recovery.

Don’t abandon your long-term investment plan based on short-term market movements. If your investment strategy was appropriate before the crash, it likely remains appropriate during and after the crash, assuming your personal circumstances haven’t changed dramatically.

Avoid putting all your available cash into the market immediately after a crash begins. Markets can continue declining for extended periods, and having cash available allows you to take advantage of even better opportunities if they arise.

Maintain Perspective

History provides valuable context during market crashes. The stock market has experienced numerous crashes, corrections, and bear markets, yet long-term investors who stayed the course have been rewarded. The S&P 500, for example, has recovered from every decline in its history and gone on to reach new highs.

Consider that some of the best investment opportunities have occurred during the worst market conditions. Investors who purchased stocks during the 2008 financial crisis, the dot-com crash of 2000-2002, or the 1987 market crash were rewarded handsomely if they held their investments long-term. To this, you can also add recent downturns due to the European debt crisis, the Covid-19 pandemic and the more recent mini-crash due to concerns about the United States and their new import tariffs. Remember that market crashes, while painful, are typically shorter in duration than bull markets (periods of positive stock market performance).

Consider Professional Financial Guidance

Market crashes can be an appropriate time to seek professional financial advice, especially if you’re feeling overwhelmed or uncertain about your investment strategy. A qualified financial adviser can provide objective perspective when emotions are running high and help you evaluate whether your current approach aligns with your long-term goals.

Look for transparent fee-based and regulated financial advisers (such as oursleves!). Avoid advisors who only get paid through commissions on products they sell, as their recommendations may be influenced by their compensation structure rather than your needs.

If you already work with a financial advisor, market crashes are excellent times to reassess that relationship. If your advisor is difficult to reach during market stress or seems to be panicking alongside you, it may be time to find new representation.

How Aisa International France Can Help

At Aisa International France, we understand that market crashes can be among the most stressful periods in an investor’s journey. We specialise in helping clients navigate volatile markets with confidence and clarity.

We provide comprehensive financial planning services that go beyond simple investment management. During market downturns, we are ready to discuss with clients whether any changes to your investment portfolio or financial plan should be made. We are also ready to review the performance of your existing investment funds to see how they have performed during the crash relative to similar funds in the same category.

We are committed to acting in our clients’ best interests. Our fee-transparent structure ensures our recommendations are driven by your financial success rather than commission opportunities. Contact us at support@aisainternational.fr for a conversation on how we could help you manage your finances through market volatility and beyond.

Plan for the Future

Use market crashes as learning experiences to improve your investment approach. Assess how you handled the stress and volatility, and consider whether your asset allocation truly matches your risk tolerance.

Build larger emergency funds if the crash revealed weaknesses in your financial foundation. Market crashes often reveal gaps in understanding about portfolio construction, risk management, or investment fundamentals and this could be a good time to contact a reputable financial advisory firm in order to have your portfolio professionally reviewed.

Conclusion

Stock market crashes test every investor’s resolve, but they also create opportunities for those who remain disciplined and focused on long-term goals. The investors who build lasting wealth are typically those who can maintain perspective during difficult periods and continue executing their investment plans despite short-term volatility.

Remember that successful investing is as much about psychology as it is about financial knowledge. Developing the emotional discipline to stay calm during crashes and the patience to wait for recoveries is often more valuable than any specific investment strategy.

While market crashes are never pleasant experiences, they’re inevitable parts of investing in growth assets. By preparing mentally and financially for these events, you can navigate them successfully and potentially emerge in a stronger financial position.

Finally, we can recommend the following French government websites in order to keep up to date with financial changes in France (along with our blog of course!):