What is the latest news on French mortgages?

According to the Observatoire Crédit Logement, the average rate for new mortgages in July was 3.62%, this is a fall from 3.66% in June (August’s data is expected in September). This average rate can be broken down three different averages, depending upon the length of the mortgages:

- 15 year mortgage: 3.49%

- 20 year mortgage: 3.50%

- 25 year mortgage: 3.60%

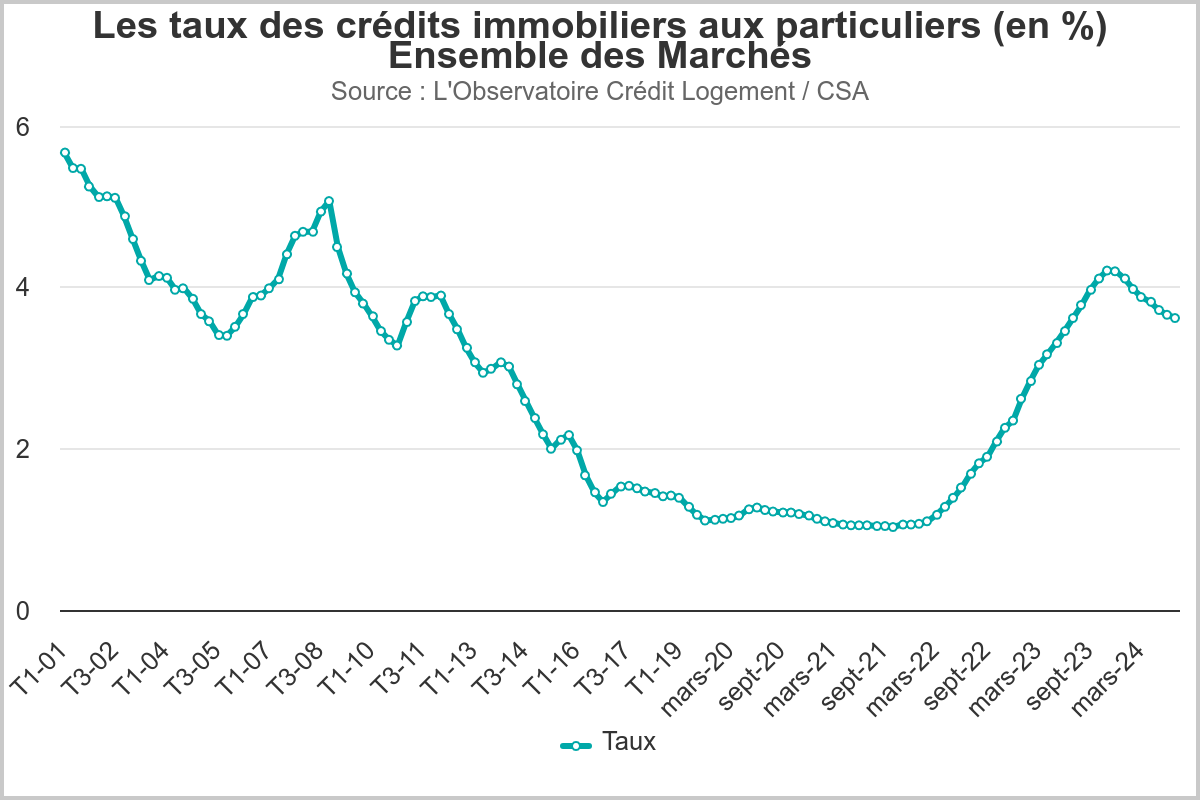

As you may have noticed, their numbers in July are not very coherent because 3.62% is higher than all three of these numbers. Mortgages greater than 25 years are very rare in France and only exist in certain conditions, such as when building a new property, so it is not as though there is a hidden 30-year mortgage rate that is dragging the average up to 3.62%. Normally, all of their numbers are coherent. You can find a chart which shows the evolution of average French mortgage rates since 2001 below:

These average mortgage rates, whilst lower than their high of 4.21% in November 2023, are still much higher than in 2020 and 2021, when average interest rates were between 1.05% and 1.1% (for 25 year mortgages, the rates were often between 1.20% and 1.25%). Note that in France, interest rates are usually fixed throughout the whole lifetime of the mortgage.

The average term of new mortgages has also increased slightly to 251 months, or 20 years and 11 months. This is up from 249 months in June, but lower than the 253 months recorded in October 2023.

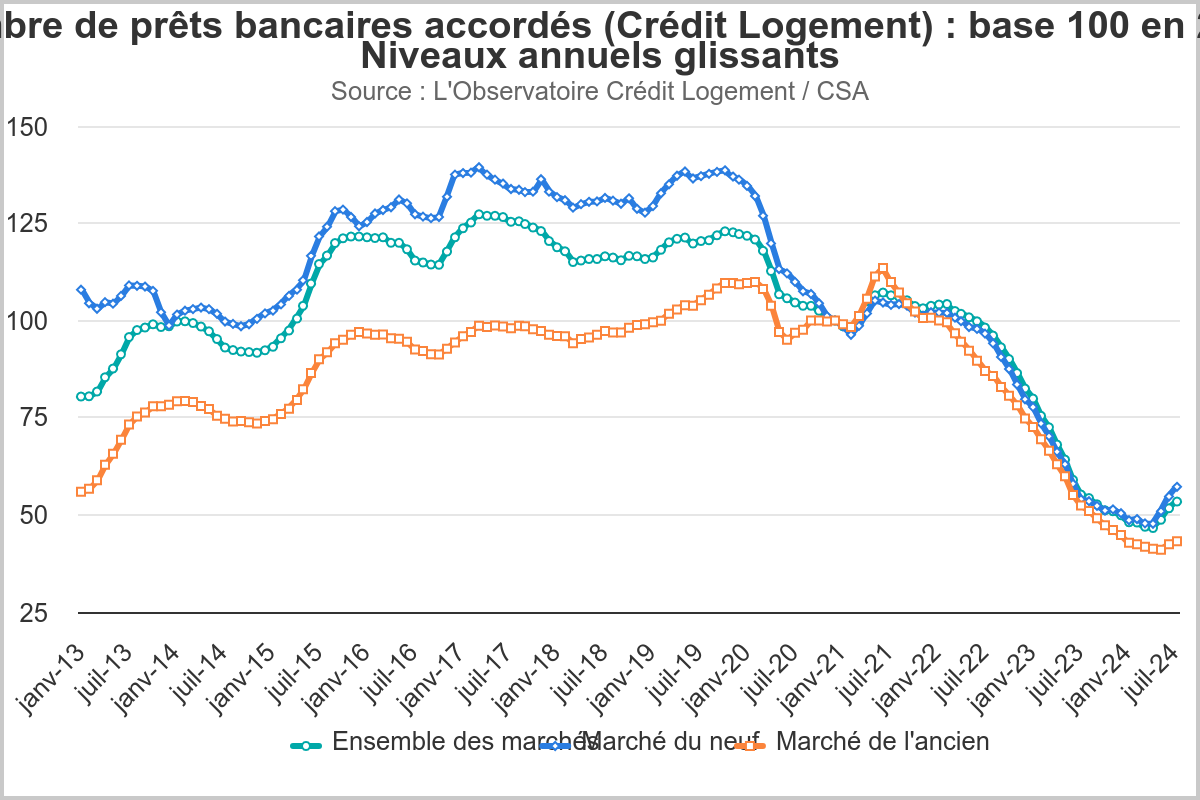

The number of mortgages that have been issued has also increased in recent months. This is very important because the number of mortgages being offered by the banks started to drop considerably from March 2022 and only started to recover in May 2024. This meant that people who seemed to meet the mortgage criteria, often failed to obtain a mortgage because of a tightening of the conditions. This was especially true for anyone without a permanent French employment contract. You can see the fall in a graph of mortgage production figures since January 2013 below:

How can Aisa International France help you with French mortgages?

We have years of experience in the French mortgage market and can produce a borrowing capacity estimation for you, and possibly put you in touch with a bank for property purchases in France or Monaco. Feel free to contact us here.

The views expressed in this article are not to be construed as personal advice. Therefore, you should contact a qualified, and ideally, regulated adviser in order to obtain up-to-date personal advice with regard to your own personal circumstances. Consequently, if you do not, then you are acting under your own authority and deemed “execution only”. Additionally, the author does not accept any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Importantly, this article is dated and is based on legislation as of the date. It should be noted that legislation changes, but articles are rarely updated. Sometimes a new article is written; so, please check for later articles. Additionally, check for changes in legislation on official government websites. Finally, this article should not be relied on in isolation.